customers whose deposits contain counterfeit notes or forged instruments.branches that have a great deal more cash transactions than usual (Head Office statistics detect aberrations in cash transactions).frequent exchange of cash into other currencies.customers who seek to exchange large quantities of low denomination notes for those of higher denomination.customers who constantly pay in or deposit cash to cover requests for money transfers, bankers drafts or other negotiable and readily marketable money instruments.cheques, Letters of Credit, Bills of Exchange, etc.)

company accounts whose transactions, both deposits and withdrawals, are denominated by cash rather than the forms of debit and credit normally associated with commercial operations (e.g.customers who deposit cash by means of numerous credit slips so that the total of each deposit is unremarkable, but the total of all the credits is significant.

substantial increases in cash deposits of any individual or business without apparent cause, especially if such deposits are subsequently transferred within a short period out of the account and/or to a destination not normally associated with thecustomer.unusually large cash deposits made by an individual or company whose ostensible business activities would normally be generated by cheques and other instruments.Money Laundering using cash transactions.You may file Forms W-2 and W-3 electronically (IRS).Form 1040 Schedule C (Profit or Loss from (IRS).Form 2017: 1040EZ Income Tax Return for Single (IRS).Form 2018: Foreign Address and Third Party Designee (IRS).Form 8995: Qualified Business Income Deduction Simplified Computation (IRS).

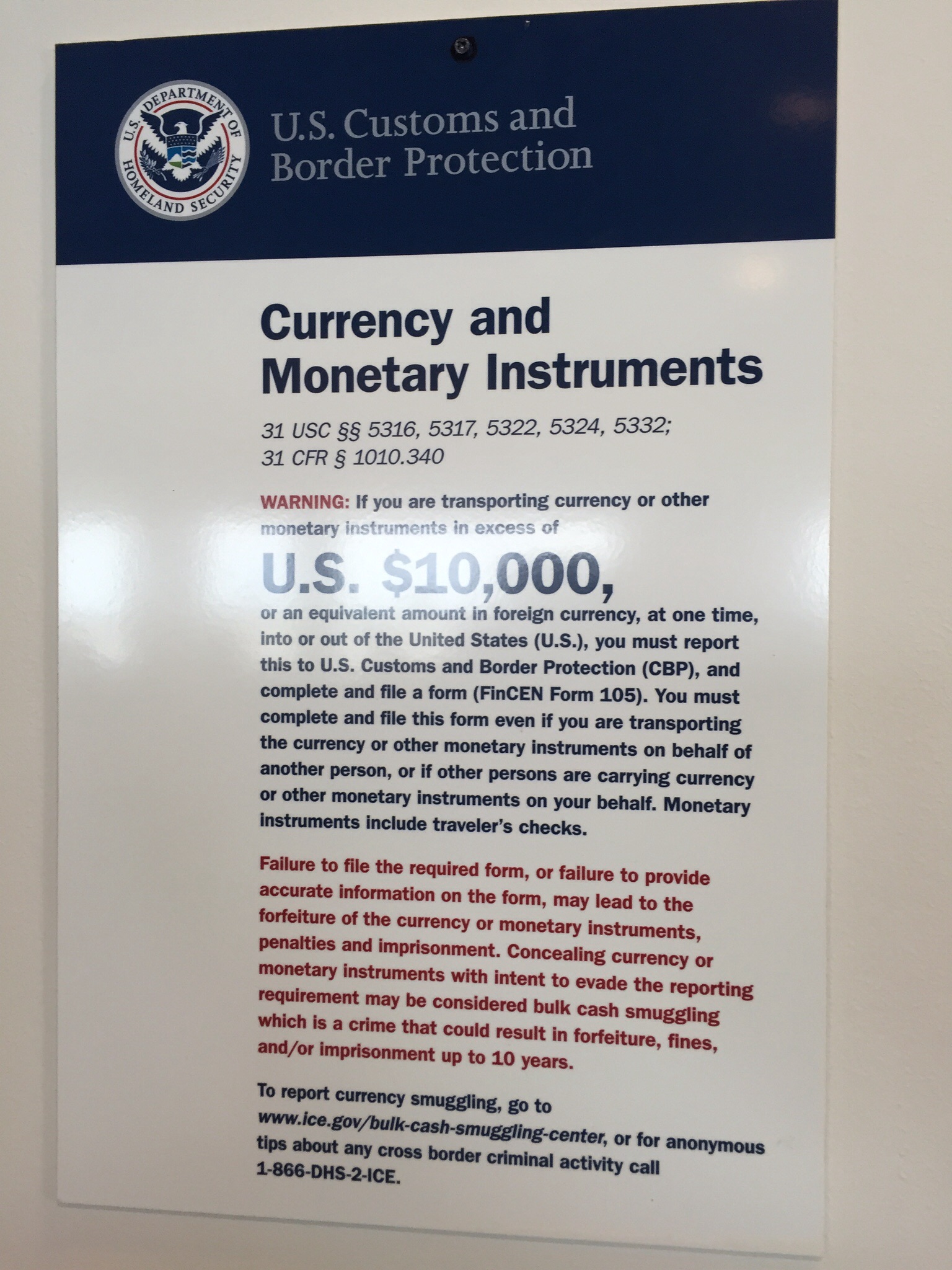

#Currency transaction report forms registration

#Currency transaction report forms pdf

Use Fill to complete blank online IRS pdf forms for free. Fill Online, Printable, Fillable, Blank Currency Transaction Report (IRS) Form

0 kommentar(er)

0 kommentar(er)